- USD/JPY rallies sharply on hawkish remarks of Federal Reserve Chair Powell.

- Powell: “the ultimate level of interest rates is likely to be higher than previously anticipated.”

- USD/JPY Price Analysis: The pair is neutral upwards, but it could reach 137.00 in the near term.

The USD/JPY climbs 0.63% on Tuesday as the US Federal Reserve (Fed) Chair Jerome Powell’s testimony began at the United States (US) Congress. Sentiment shifted sour after US equities opened in the green. Nevertheless, as Powell took the stand, he rocked the boar. At the time of writing, the USD/JPY is exchanging hands at 136.87.

USD/JPY aims toward 136.90s on Powell’s hawkish speech

In a speech prepared by the Federal Reserve Chair Powell, he said that the Fed would need to raise rates more than expected and that the pace of rate hikes could increase. He added, “The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated.”

Powell reiterated that even though inflation is moderating, “the process of getting inflation back down to 2% has a long way to go and is likely to be bumpy.”

The US Dollar Index (DXY), a measure of the buck’s value against a basket of peers, is rallying 0.84%, up at 105.161. At the same time, the US 10-year Treasury bond yield recovered its lost ground and is back above the 4% threshold, a headwind for the USD/JPY.

Once Powell’s speech crossed the screens, the USD/JPY jumped towards daily highs at 136.90 after meandering around 136.20.

On the Japanese front, in its final policy meeting with Governor Haruhiko Kuroda this week, Japan’s central bank will maintain its very loose monetary stance. Tuesday’s data showed that real wages in Japan fell the most in nine years in January amidst four-decade-high inflation squeezing Japanese purchasing power.

USD/JPY Technical analysis

From a daily chart perspective, the USD/JPY remains neutral to upward biased. A decisive break above the YTD high at 137.10 would provide the USD/JPY fresh impetus towards the December 20 high of 137.48. Once cleared, the USD/JPY would rally toward the December 15 high of 138.15, followed by the 139.00 figure. On the flip side, if the USD/JPY turns bearish, the major could fall as low as March’s 6 low of 135.36 before testing the 135.00 threshold.

USD/JPY Technical levels

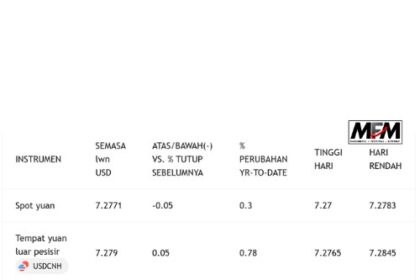

USD/JPY

| OVERVIEW | |

|---|---|

| Today last price | 136.79 |

| Today Daily Change | 0.80 |

| Today Daily Change % | 0.59 |

| Today daily open | 135.99 |

| TRENDS | |

|---|---|

| Daily SMA20 | 134.27 |

| Daily SMA50 | 132.15 |

| Daily SMA100 | 136.5 |

| Daily SMA200 | 137.35 |

| LEVELS | |

|---|---|

| Previous Daily High | 136.19 |

| Previous Daily Low | 135.37 |

| Previous Weekly High | 137.1 |

| Previous Weekly Low | 135.26 |

| Previous Monthly High | 136.92 |

| Previous Monthly Low | 128.08 |

| Daily Fibonacci 38.2% | 135.88 |

| Daily Fibonacci 61.8% | 135.68 |

| Daily Pivot Point S1 | 135.51 |

| Daily Pivot Point S2 | 135.03 |

| Daily Pivot Point S3 | 134.69 |

| Daily Pivot Point R1 | 136.33 |

| Daily Pivot Point R2 | 136.67 |

| Daily Pivot Point R3 | 137.15 |